Accounting & Finance Finance and Compliance

A flight cabin crew with linguistic background got a compliance job after completing this programme.

This programme is practical and helps your career advancement. It covers various aspects such as Insurtech, AML, impact of AI and Big Data which are hotly demanded by the industries.

Graduates of Postgraduate Diploma in Bank and Insurance Compliance could claim 3 exemptions from the Postgraduate Diploma in Corporate Compliance!!

Programme Overview

Highlights

All modules of the programme are CEF reimbursable.

Extended non-means-tested loans Scheme (ENLS) from Government.

(ENLS Course Code: B00600351)

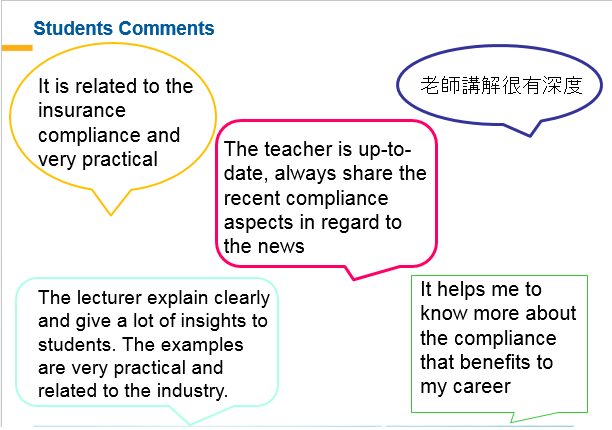

COMMENTS FROM OUR CURRENT STUDENTS!

風險和合規部門的需求及前景 – 前線員工都要識合規!

【風險和合規部門的需求及前景 – 前線員工都要識合規!】

羅兵咸永道的第六次《風險評估年度報告》顯示指出,由於合規需求日增,企業除了有專屬的風險和合規部門外,更多公司需要前線業務部門(如銷售團隊)在風險管理上也擔當一定的角色。 56%受訪的亞太區企業計劃在未來三年將風險管理擴大到第一道防線,全球回應率為 46%。

與時俱進,不懼淘汰的風險,即瀏覽:>https://goo.gl/amnRSe

【十年經驗Compliance,年薪可以過百萬?】

無論金融機構規模大小,招聘合規人手幾乎都是指定動作。 基本上受證監會或金管局規管的機構就必須遵守合規要求,故此不論大小金融機構近年皆對合規員工對才若渴。隨著經驗的累積,三至五年經驗的 seniors 月入三、四萬元亦非難事。能夠在合規界別屹立十年而不倒,有機會年薪過百萬。

Source: JobsDB ( https://bit.ly/3jF9v4m )

>#enterprise >#risk >#management >#accounting >#compliance >#insurance>#corporate

Programme Details

Programme Objective

The programme aims to provide students with a coherent, relevant and practical programme to equip them for a career in compliance and related sectors. It has a systematic body of theory and knowledge on compliance but at the same time it is designed to be very practical and problem based oriented. The main focus of this programme is its emphasis upon the importance of compliance issues in the increasingly stringent regulatory environment.

Programme Structure

This programme offers six modules in three intakes; Feb, May and Oct each year, duration of each range from 33 to 36 contact hours.

- Internal Controls - Concepts and Issues

- Compliance for Fintech and Insurtech

- Compliance in Banking Sector (core)

- Compliance in Insurance Sector (core)

- Anti-money Laundering-practices and issues OR Anti-money Laundering-Cryptocurrency, Data Analytics and Financial Crime Sanctions

- Impact of Artificial Intelligence and Big Data on Compliance and Risk Management

The programme provides students with knowledge relating to regulatory environment as well as governance from strategic and operational perspectives. Students would be updated with the most contemporary knowledge and development in bank and insurance compliance under the new technology landscape as well. Graduates would be able to better manage risk and comply with rules with higher standard and greater confidence.

Award

Upon successful completion of two core modules and any other four elective modules, students will be awarded with Postgraduate Diploma in Bank and Insurance Compliance of 60 credits. (**Students are required to pass both continuous assessment (50%) and the final examination (50%) in order to pass a module.**)

TUTOR'S PROFILE

Internal Controls - Concepts and Issues - Mr Patrick Rozario (CPA (Aust); CISA; IIA)

Mr Patrick A Rozario is a Managing Director of Moore Stephens and heads up the firm's Advisory Services to help our clients manage their risks and enhance their business operations.Patrick Rozario has over 25 year experiences working in various internal audits, corporate governance, Sarbanes-Oxley, internal control and information technology risk assurance advisory engagements . Patrick is also the Chairman of the organising committee for the HKICPA Best Corporate Governance Disclosure Awards 2013, 2014 and 2015.

Compliance in Insurance Sector / Compliance for Fintech and Insurtech -

Dr. Gary Yiu (DBA (SBS), MSc(CUHK), MSc(HKPU), CPE, FCPA, CISA, CORM, CCEBS)

Dr. Yiu is the Executive Director and Head of Operational Risk Management for DBS Hong Kong. He is a seasoned risk and audit leader with a career spanning banking, financial infrastructure, and professional services. His previous senior roles include heading the risk management function for a Hong Kong clearing house, serving as Assistant General Manager for the internal audit function of a note-issuing bank, and holding the position of Associate Director at a Big-4 firm. Over the past 10 years, he has also shared his expertise as a lecturer for numerous academic and professional programmes.

His professional excellence has been recognized with multiple awards, including the HKICT Award in Regtech and Risk Management from the Digital Policy Office, the Cyber Security Professionals Award from the Hong Kong Police Force, an Outstanding Service Award from a note-issuing bank, and a Work Innovation Award from a Big Four firm.

Anti-Money Laundering – Practices and Issues - Mr. Albert Tang (Group Chief Risk & Compliance Officer and Manager In Charge of various function of SFC)

Mr. Albert Tang has over 23 years of experience in Anti-Money Laundering/Counter Terrorist Finance control that covered the Law Enforcement, public sector, financial industry and fintech business. He now oversees the Risk, Compliance and Internal control function of a Financial Fintech group and is responsible for the overall Group Corporate governance management, risk & compliance of the SFC supervision of asset investment, fintech business development with AI. Previously, he played key person in Compliance role in Hong Kong based Insurance Institution and also worked in a Hong Kong Listed technology Companies, PCCW/HKT supervised a team of compliance professionals in charge of all compliance-related activities across all financial service including Stored Value Facilities licenses, Virtual Bank, Insurance service, Money lending and FinTech business development and act as key contact with Hong Kong Monetary Authority.

He has previously worked in various financial institutions, including banking, insurance and card payment operations across Asia Pacific region. Before moving to the financial industry, he had served the Independence Commission Against Corruption of Hong Kong over 7 years dedicated to fighting corruption through investigation.

Impact of Artificial Intelligence and Big Data on Compliance and Risk Management - Mr. F. W. Wan, BSc, MSc, CISA

Mr. Wan leads advisory practice across AI/RPA, Virtual Bank, Robo-Advisory and Digital Payment in an international consulting firm. Prior to joining the consulting sector, Mr. Wan was a regulator with primary focus on policy setting and issuing codes in relation to Regtech, Algo/Electronic Trading, Dark Pool and Robo-Advisory areas. Previously, he also played a lead role in driving Asia Pacific technology audit in a Top-tier US investment bank. He holds Master of Science degree.

Loretta has over 17 years experience in performing financial audit and internal audit in both professional firms and listed companies in Hong Kong respectively. She has worked as senior positions of internal audit department for listed companies in Hong Kong. In addition, she has extensive experience in providing service for pre-IPO internal control review application, internal control review and other internal audit engagements as she had worked in consultancy firm and professional firm for over 6 years.

Exemptions

- Maximum exemption is up to 50% of the number of modules studied. The exemption application must be made in writing with supporting documents at the same time when submitting the application form for the programme. Application fee of each module exemption is HK$500 (Non-refundable). Those with exempted modules are required to pay a fee of HK$1,000.

FAQ

- Could I get exemption of the following if I am an associate member of HKICS?

Corporate Governance - Yes

- How can emeption fees be waived?

Exemption fees are waived for Postgraduate Diploma in Corporate Compliance and Postgraduate Diploma in Enterprise Risk Management

| Application Code | 2370-AC055A | Apply Online Now |

| Apply Online Now | ||

Duration

- 33 to 36 hours per module

- 11 to 13 meeting(s)

Modules & Class Details

Modules

Module offered in FEB 2026 intake:

*TBC = To be confirmed

(End date = Exam date)

Anti-money Laundering – Practices and Issues

Date: 05 February 2026 - 07 May 2026 (Thursday)

Time: 19:00-22:00

Venue: ADC (Admiralty Learning Centre)

Compliance in Insurance Sector

Date: 14 February 2026 - 16 May 2026 (Saturday)

Time: 19:00-22:00

Venue: IEC (Island East Campus)

Remarks: The time of the lesson on 14 February 2026 will be changed from 19:00–22:00 to 14:00–17:00.

Internal Controls – Concepts and Issues

Date: 09 February 2026 - 18 May 2026 (Monday)

Time: 19:00-22:00

Venue: TBC

*The date of examination is included in the above class period.

Modules will offered in FEBRUARY, MAY AND OCTOBER intake each year(tentatively):

|

Intake |

Postgraduate Diploma in Corporate Compliance |

Postgraduate Diploma in Bank and Insurance Compliance |

|

February

|

Listing Rules and Regulations Practices

|

Compliance in Insurance Sector (core)

|

|

Anti-money Laundering – Practices and Issues

|

||

|

Internal Controls – Concepts and Issues

|

||

|

May

|

Impact of Artificial Intelligence and Big Data on Compliance and Risk Management

|

|

|

Anti-money Laundering – Cryptocurrency, Data Analytics and Financial Crime Sanctions

|

||

|

Securities and Futures Regulations and Practices (core)

|

Compliance in Banking Sector (core)

|

|

|

October

|

Environmental, Social and Governance Reporting

|

Compliance for Fintech and Insurtech

|

|

Corporate Governance (core)

|

|

|

Either weekday evenings, 7:00 - 10:00 pm or, Saturday afternoons, 2:00 - 5:00 pm, or Saturday evenings, 7:00 - 10:00 pm, or Sunday afternoon, 2:00 - 5:00 pm.

Class Details

TENTATIVE SCHEDULE

2026 Feb Intake (Tentative)

*TBC = To be confirmed

| Module Code | Module Name | Class Period | Time | Venue |

| FINA6162 |

Anti-money Laundering – Practices and Issues |

05 Feb 2026 - 07 May 2026 (Thursday) |

19:00-22:00 | ADC |

| ACCT6058 | Compliance in Insurance Sector |

14 Feb 2026 - 16 May 2026 (Saturday) |

19:00-22:00 | IEC |

| ACCT6079 | Internal Controls – Concepts and Issues | 09 Feb 2026 - 18 May 2026 (Monday) | 19:00-22:00 | TBC |

Notes: The venue, time and date arrangements are subject to final confirmation, HKU SPACE reserves the right to make changes at any time without notice.

The date of examination is included in the above class period.

Fee & Entry Requirements

Fee

HK$200 (non-refundable)

Course Fee- Course Fee : HK$8300 per module (Course Fees paid are not refundable and transferable if courses are successfully commenced in any one of HKU SPACE Learning Centers except as statutorily provided or under very exceptional circumstances)

Entry Requirements

Applicants shall hold a bachelor’s degree awarded by a recognized institution.

If the degree or equivalent qualification is from an institution where the language of teaching and assessment is not English, applicants shall provide evidence of English proficiency, such as:

- an overall band of 6.0 or above with no subtests lower than 5.5 in the IELTS; or

- a score of 550 or above in the paper-based TOEFL, or a score of 213 or above in the computer-based TOEFL, or a score of 80 or above in the internet-based TOEFL; or

- HKALE Use of English at Grade E or above; or

- HKDSE Examination English Language at Level 3 or above; or

- equivalent qualifications.

Applicants with other qualifications will be considered on individual merit.

Notes to applicants:

1. Applicants with relevant prior studies can apply for exemption,please complete the exemption form and furnish course outline.

CEF

- The CEF Institution Code of HKU SPACE is 100

| CEF Courses | ||

|---|---|---|

| Impact of Artificial Intelligence and Big Data on Compliance and Risk Management (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z108368 | FEES $8,300 | ENQUIRY 2867-8409 |

| Internal Controls - Concepts and Issues (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z149862 | FEES $8,300 | ENQUIRY 2867-8409 |

| Compliance in Banking Sector (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z149870 | FEES $8,300 | ENQUIRY 2867-8409 |

| Compliance in Insurance Sector (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z149889 | FEES $8,300 | ENQUIRY 2867-8409 |

| Corporate Governance (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z120643 | FEES $7,000 | ENQUIRY 2867-8409 |

| Anti-money Laundering-practices and issues (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z12066A | FEES $8,300 | ENQUIRY 2867-8409 |

| COMPLIANCE FOR FINTECH AND INSURTECH (MODULE FROM POSTGRADUATE DIPLOMA IN BANK AND INSURANCE COMPLIANCE) | ||

| COURSE CODE 33Z134008 | FEES $8,300 | ENQUIRY 2867-8409 |

| Anti-money Laundering – Cryptocurrency, Data Analytics and Financial Crime Sanctions (Module from Postgraduate Diploma in Bank and Insurance Compliance) | ||

| COURSE CODE 33Z140334 | FEES $8,300 | ENQUIRY 2867-8409 |

|

Continuing Education Fund Reimbursable Course (selected modules only) Some modules of this course have been included in the list of reimbursable courses under the Continuing Education Fund. |

Postgraduate Diploma in Bank and Insurance Compliance

|

Apply

Online Application Apply Now

Application FormDownload Application Form

Application Form

1. Cash, EPS, WeChat Pay Or Alipay

Course fees can be paid by cash, EPS, WeChat Pay or Alipay at any HKU SPACE Enrolment Centres.

2. Cheque Or Bank draft

Course fees can also be paid by crossed cheque or bank draft made payable to “HKU SPACE”. Please specify the programme title(s) for application and applicant’s name. You may either:

- bring the completed form(s), together with the appropriate course or application fees in the form of a cheque, and any required supporting documents to any of the HKU SPACE enrolment centres;

- or mail the above documents to any of the HKU SPACE Enrolment Centres, specifying “Course Application” on the envelope. HKU SPACE will not be responsible for any loss of personal information and payment sent by mail.

3. VISA/Mastercard

Applicants may also pay the course fee by VISA or Mastercard, including the “HKU SPACE Mastercard”, at any HKU SPACE enrolment centres. Holders of the HKU SPACE Mastercard can enjoy a 10-month interest-free instalment period for courses with a tuition fee worth a minimum of HK$2,000; however, the course applicant must also be the cardholder himself/herself. For enquiries, please contact our staff at any enrolment centres.

4. Online Payment

Online application / enrolment is offered for most open admission courses (enrolled on first come, first served basis) and selected award-bearing programmes. Application fees and course fees of these programmes/courses can be settled by using "PPS by Internet" (not available via mobile phones), VISA or Mastercard. In addition to the aforesaid online payment channels, new and continuing students of award-bearing programmes with available online service, they may also pay their course fees by Online WeChat Pay, Online Alipay or Faster Payment System (FPS). Please refer to Enrolment Methods - Online Enrolment for details.

Notes

-

If the programme/course is starting within five working days, application by post is not recommended to avoid any delays. Applicants are advised to enrol in person at HKU SPACE Enrolment Centres and avoid making cheque payment under this circumstance.

-

Fees paid are not refundable except under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment), subject to the School’s discretion. In exceptional cases where a refund is approved, fees paid by cash, EPS, WeChat Pay, Alipay, cheque, FPS or PPS by Internet will be reimbursed by a cheque, and fees paid by credit card will be reimbursed to the credit card account used for payment.

- In addition to the published fees, there may be additional costs associated with individual programmes. Please refer to the relevant course brochures or direct any enquiries to the relevant programme team for details.

- Fees and places on courses cannot be transferrable from one applicant to another. Once accepted onto a course, the student may not change to another course without approval from HKU SPACE. A processing fee of HK$120 will be levied on each approved transfer.

- HKU SPACE will not be responsible for any loss of payment, receipt, or personal information sent by mail.

- For payment certification, please submit a completed form, a sufficiently stamped and self-addressed envelope, and a crossed cheque for HK$30 per copy made payable to “HKU SPACE” to any of our enrolment centres.

- More Programmes of

- Finance and Compliance Accounting

- Relevant Programmes

- Postgraduate Diploma in Corporate Compliance