Accounting & Finance Finance and Compliance

Today and Upcoming Events

Accept New Applications for May 2026 intake! There will be practical classes in the computer laboratory. The programme covers big data processing lifecycle, business challenges as well as big data opportunities in business and finance. Also, our seasoned lecturer discussed various managerial issues related to big data governance as well as data security and compliance. Welcome to your online application!

Programme Overview

Highlights

Programme Details

On completion of the programme, students should be able to

-describe big data concepts and related ethical issues of data collection and handling;

-identify opportunities and threats using big data;

-explain how various technological elements enhance governance and compliance;

-analyze potential risks and challenges in handling fraud detection and prevention; and

-discuss the standards and best practices of data security and compliance.

| Application Code | 2385-FN055A | Apply Online Now |

| Apply Online Now | ||

Days / Time

- Tue, Fri, 7:00pm - 10:00pm

- 30 hours per programme

- Hong Kong Island Campus

- Kowloon East Campus

- Kowloon West Campus

Modules & Class Details

Modules

Course Content :

|

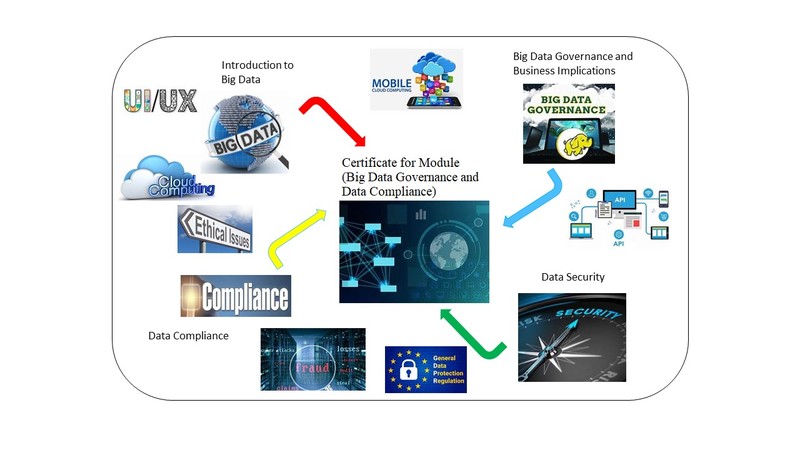

(1) Introduction to Big Data

(2) Big Data Governance and Business Implications

(3) Data Security and Compliance

|

Upon successful completion of the programme, students who have pass the continuous assessment and final assessment with attendance no less than 70% will be awarded within the HKU system through HKU SPACE a Certificate for Module (Big Data Governance and Data Compliance).

Teacher

(1) Prof Stephen Ng

Prof. Ng is a seasoned executive for InnoTech ICT and Digital business. He launched many first innotechs in the region, namely the first Broadband, 3G, 4G, e-commerce, m-commerce, Mobile Apps, SaaS cloud, Biometric IDaaS, AI automation, Social Analytics through Machine Learning etc., Graduates of FinTech, AI, and Education from various Universities including Oxford and Bristol. He has obtained professional qualifications including Finance, IT, Security, Psychology, Education, Legal Studies and Management.

Professor Ng has taught the existing programme at HKU SPACE with topics related to Big Data, Governance & Compliance over three years as well as delivered the various seminars related to Big Data, AI and FinTech.

He has served as Company Doctor and Mentor for Corporates and Startups over years, successfully helping Intellectuals Transfer and Wisdom Inspirations on different dimensions across industries and governments in the region as well as sharing and inspiring Executives at various levels from his rich insights and experiences.

Professor Ng was also invited as Honouray Advisor for various international NGOs, forums, academics and professional settings. He has proactively promoted Mindfulness-Based Entreprenuarship & Intelligence Transformations in Public and Private sectors, and proposed the Happiness Value-Chain approach in Business Transformation and Benchmarking on international leadership forums.

He has received various awards from government and renowned communities from Tech Gibs to Life Hackings, included NASA, TechCrunch & HKSAR government etc. Currently, he is conducting R&D projects in Blockchain 4.0, RegTech 2.0 designs and various startup projects. He continues serving the MindTech disruptions towards better Humanity and Technological Advancements.

(2) Mr Thomas Lee

Mr Lee is an experienced technology and project management professional with over 30 years of experience in the IT and data science industries. He currently serves as an Adjunct Lecturer at HKU SPACE, where he teaches and mentors learners in emerging technologies and applied data disciplines. He also holds a Master’s degree in biomedical engineering from the University of Toronto, Canada, strengthening his foundation in analytical thinking, systems engineering, and applied innovation.

His career spans major global vendors, including HP Inc., Dell, Fossil, Motorola Network, and GP Batteries, where he led initiatives in new product introduction (NPI), design for manufacturability (DFM), quality assurance, and production risk management across China and Taiwan. His work integrates engineering rigor with data‑driven methodologies to improve manufacturing performance and operational resilience.

A Microsoft Certified Trainer (MCT) and long‑standing PMP, Mr Lee has been teaching Big Data, Cloud Computing, Machine Learning, Cyber Security, and Fintech since 2020. His teaching style blends academic depth with practical, industry‑grounded insights, making complex cloud and AI concepts accessible to learners at all levels.

He holds advanced certifications, including MCTAA, AWS‑SAA, AWS‑AIP, AWS‑DEA, and AWS‑MLEA, supporting his consulting work in cloud architecture, AI adoption, and data engineering. His current focus is on leveraging artificial intelligence to drive Inclusion and Accessibility, helping organizations build more equitable digital solutions.

Class Details

Timetable

| Lecture | Date | Time |

| 1 | 5 May 26 (Tue) | 19:00-22:00 |

| 2 | 12 May 26 (Tue) | 19:00-22:00 |

| 3 | 15 May 26 (Fri) | 19:00-22:00 |

| 4 | 19 May 26 (Tue) | 19:00-22:00 |

| 5 | 22 May 26 (Fri) | 19:00-22:00 |

| 6 | 26 May 26 (Tue) | 19:00-22:00 |

| 7 | 29 May 26 (Fri) | 19:00-22:00 |

| 8 | 2 Jun 26 (Tue) | 19:00-22:00 |

| 9 | 5 Jun 26 (Fri) | 19:00-22:00 |

| 10 | 9 Jun 26 (Tue) | 19:00-22:00 |

Remarks: Tentative timetable is subject to change, and course commencement is subject to sufficient enrollment numbers.

Fee & Entry Requirements

Fee

HK$150 (Non-refundable)

Course Fee- Course Fee: $9500 per programme (* course fees are subject to change without prior notice)

Entry Requirements

Applicants should hold an Advanced Diploma, a Higher Diploma or an Associate Degree awarded by a recognized institution. Applicants with other equivalent qualifications will be considered on individual merit.

**Please upload copy of HKID and proof of degree while applying online.

CEF

- The CEF Institution Code of HKU SPACE is 100

| CEF Courses | ||

|---|---|---|

| CERTIFICATE FOR MODULE (BIG DATA GOVERNANCE AND DATA COMPLIANCE) 證書(單元: 大數據治理及數據合規) |

||

| COURSE CODE 33C131595 | FEES $9,500 | ENQUIRY 2867-8331 |

|

Continuing Education Fund This course has been included in the list of reimbursable courses under the Continuing Education Fund. |

Certificate for Module (Big Data Governance and Data Compliance)

|

Apply

Online Application Apply Now

Application Form Download Application Form

Enrolment MethodOnline Enrolment

HKU SPACE provides 24-hour online application and payment service for students to apply to selected award-bearing programmes and to enrol in most open admission courses (courses enrolled on a first come, first served basis) via the Internet. Applicants may settle the payment by using either "PPS by Internet" (not available via mobile phones), VISA or Mastercard online. Online WeChat Pay, Online AliPay and Faster Payment System (FPS) are also available for continuing enrolment in the same programme, if online service is offered.

For first time enrolment

-

Complete the online application form

Applicant may click the icon

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

Some programmes/courses may admit by selection, and may require applicants to provide electronic copy of any required documents (e.g. proof of qualification) as indicated on the programme/course webpage. Only file format in doc, docx, jpg and pdf are supported. -

Make Online Payment

Pay the application or programme/course fees by either using:

"PPS by Internet" - You will need a PPS account and a PPS Internet password. For information on how to open a PPS account and how to set up a PPS Internet password, please visit http://www.ppshk.com.

*Credit Card Online Payment - Course fees can be paid by VISA or Mastercard including the “HKU SPACE Mastercard”.

* HKU SPACE Mastercard cardholders who wish to enjoy 10-month interest free instalment scheme must pay their tuition fees in person at any of our HKU SPACE Enrolment Centres.

To know more about first-time online application/enrolment and payment, please refer to the user guide of Online Application / Enrolment and Payment:

For continuing enrolment in the same programme

Selected programmes offer online continuing enrolment service. Programme staff will inform students if they offer this service and offer further enrolment details.

Online Payment can be made via "PPS by Internet" (not available via mobile phones), VISA or Mastercard, Online WeChat Pay, Online AliPay and Faster Payment System (FPS)

In Person / Mail

For first time enrolment

-

For first come, first served short courses, complete the Application for Enrolment Form SF26 and bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

[Download Enrolment Form SF26] -

Award-bearing and professional courses may require other information. Forms are usually available at the enrolment centres or on request from programme staff. Bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

For continuing enrolment in the same programme

-

The standard ‘Enrolment/Payment Slip’ is designed for students of award-bearing programmes or remaining programmes in a suite of programmes requiring continuing enrolment and it applies to most programmes.

-

Students should complete the “Enrolment/Payment Slip” which will be made available by relevant programme staff and return the slip to any HKU SPACE enrolment centre or post it to the relevant programme staff with appropriate fee payment.

Please refer to available Payment Methods for fee payment information. If you are in doubt about the procedures, please check the individual course details, or contact our programme staff or enrolment centres.

Please note the followings for programme/course enrollment:

- To make an application online, you will need a computer with connection to the Internet and a web browser with JavaScript enabled. Google Chrome is recommended.

- Applicants should not leave the online application idle for more than 10 minutes. Otherwise, applicants must restart the application process.

- Only Early Bird Discount is supported for Online Applicants (Application). To enjoy other types of discount, please visit one of our enrolment centres.

- During the online application process, asynchronous application and payment submission may occur. Successful payment may not guarantee successful application. In case of unsuccessful submission, our programme staff will contact you shortly.

- Applicants are reminded that they should only apply for the same programme/course once through counter or online application.

- For online enrolment, a payment confirmation page would be displayed after payment has been made successfully. In addition, a confirmation email would also be sent to your email account. You are advised to keep your payment confirmation for future enquiries.

- Fees paid are not refundable except as statutorily provided or under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment).

- If admission is by selection, the official receipt is not a guarantee that your application has been accepted. We will inform you of the result as soon as possible after the closing date for application. Unsuccessful applicants will be given a refund of programme/course fee if already paid.

Disclaimer

The School provides a platform for online services for a selected range of products it offers. While every effort is made to ensure timeliness and accuracy of information contained in this website, such information and materials are provided "as is" without express or implied warranty of any kind. In particular, no warranty or assurance regarding non-infringement, security, accuracy, fitness for a purpose or freedom from computer viruses is given in connection with such information and materials.

The School (and its respective employees and subsidiaries) is not liable for any loss or damage in connection with any online payments made by you by reason of (i) any failure, delay, interruption, suspension or restriction of the transmission of any information or message from any payment gateways of the relevant banks and/or third party merchants for processing credit/debit/smart card or other payment facilitation mechanism; (ii) any negligence, mistake, error in or omission from any information or message transmitted from the said payment gateways; (iii) any breakdown, malfunction or failure of those gateways in effecting online payment service or (iv) anything arisen out of or in connection with the said payment gateways, including but not limited to unauthorised access to or alternation of the transmission of data or any unlawful act not permitted by the law.

1. Cash, EPS, WeChat Pay Or Alipay

Course fees can be paid by cash, EPS, WeChat Pay or Alipay at any HKU SPACE Enrolment Centres.

2. Cheque Or Bank draft

Course fees can also be paid by crossed cheque or bank draft made payable to “HKU SPACE”. Please specify the programme title(s) for application and applicant’s name. You may either:

- bring the completed form(s), together with the appropriate course or application fees in the form of a cheque, and any required supporting documents to any of the HKU SPACE enrolment centres;

- or mail the above documents to any of the HKU SPACE Enrolment Centres, specifying “Course Application” on the envelope. HKU SPACE will not be responsible for any loss of personal information and payment sent by mail.

3. VISA/Mastercard

Applicants may also pay the course fee by VISA or Mastercard, including the “HKU SPACE Mastercard”, at any HKU SPACE enrolment centres. Holders of the HKU SPACE Mastercard can enjoy a 10-month interest-free instalment period for courses with a tuition fee worth a minimum of HK$2,000; however, the course applicant must also be the cardholder himself/herself. For enquiries, please contact our staff at any enrolment centres.

4. Online Payment

Online application / enrolment is offered for most open admission courses (enrolled on first come, first served basis) and selected award-bearing programmes. Application fees and course fees of these programmes/courses can be settled by using "PPS by Internet" (not available via mobile phones), VISA or Mastercard. In addition to the aforesaid online payment channels, new and continuing students of award-bearing programmes with available online service, they may also pay their course fees by Online WeChat Pay, Online Alipay or Faster Payment System (FPS). Please refer to Enrolment Methods - Online Enrolment for details.

Notes

-

If the programme/course is starting within five working days, application by post is not recommended to avoid any delays. Applicants are advised to enrol in person at HKU SPACE Enrolment Centres and avoid making cheque payment under this circumstance.

-

Fees paid are not refundable except under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment), subject to the School’s discretion. In exceptional cases where a refund is approved, fees paid by cash, EPS, WeChat Pay, Alipay, cheque, FPS or PPS by Internet will be reimbursed by a cheque, and fees paid by credit card will be reimbursed to the credit card account used for payment.

- In addition to the published fees, there may be additional costs associated with individual programmes. Please refer to the relevant course brochures or direct any enquiries to the relevant programme team for details.

- Fees and places on courses cannot be transferrable from one applicant to another. Once accepted onto a course, the student may not change to another course without approval from HKU SPACE. A processing fee of HK$120 will be levied on each approved transfer.

- HKU SPACE will not be responsible for any loss of payment, receipt, or personal information sent by mail.

- For payment certification, please submit a completed form, a sufficiently stamped and self-addressed envelope, and a crossed cheque for HK$30 per copy made payable to “HKU SPACE” to any of our enrolment centres.

- More Programmes of

- Finance and Compliance Data Science

- Relevant Programmes

- Executive Certificate in Financial Decision Making: Big Data and Machine Learning Executive Certificate in Interpretation and Visualization of Business Big Data Executive Certificate in Applications of Blockchain in Financial Technology Executive Certificate in Applied Business Analytics and Decision Optimization Executive Certificate in Applied AI and Predictive Analytics for Business Executive Diploma in Financial Analytics Executive Certificate in Banking and Financial Technology Executive Certificate in AI and Deep Learning in Quantitative Finance Executive Certificate in Big Data and Predictive Analytics Executive Certificate in Big Data and Business Analytics Executive Certificate in Big Data, A.I. and Investing