會計及金融

發掘會計及金融的科目

會計及金融

香港的金融業發展精密完善,舉世知名,更是本地經濟的重要基石。我們致力培育金融及會計方面人材,並協助他們取得可以幫助晉升的相關資歷。照顧各階層及不同範疇金融專才的所需,我們的課程涵蓋會計學、企業管理、金融法規、金融服務和保險、金融科技、投資管理和風險管理。

我們與業界及專業機構聯繫緊密,還有跟國際上知名學府的合作無間,都是廣大金融專才支持我們的原因之一。

會計及金融課程

316 項結果

- 排序方式

- 課程名稱

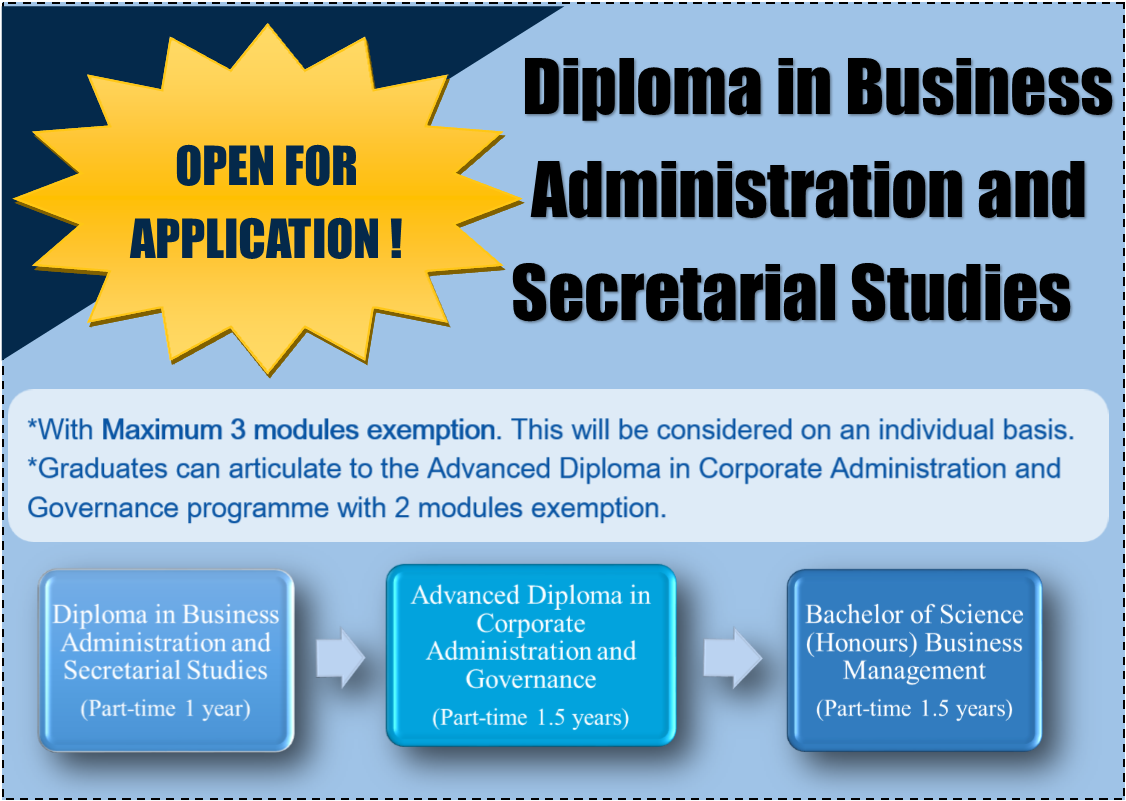

Hong Kong has a reputation for being one of the world’s freest economies, with a level playing field in commerce and a fair and equitable society abiding by the rule of law. This unique environment has continued to give Hong Kong a competitive edge. By introducing this programme, we aim to provide knowledge and skills to the workforce in the areas of business administration, secretaryship, compliance and ethics.

PT

Start 24 FEB 2026 (TUE)

Duration 12 months

Fee HK$4350

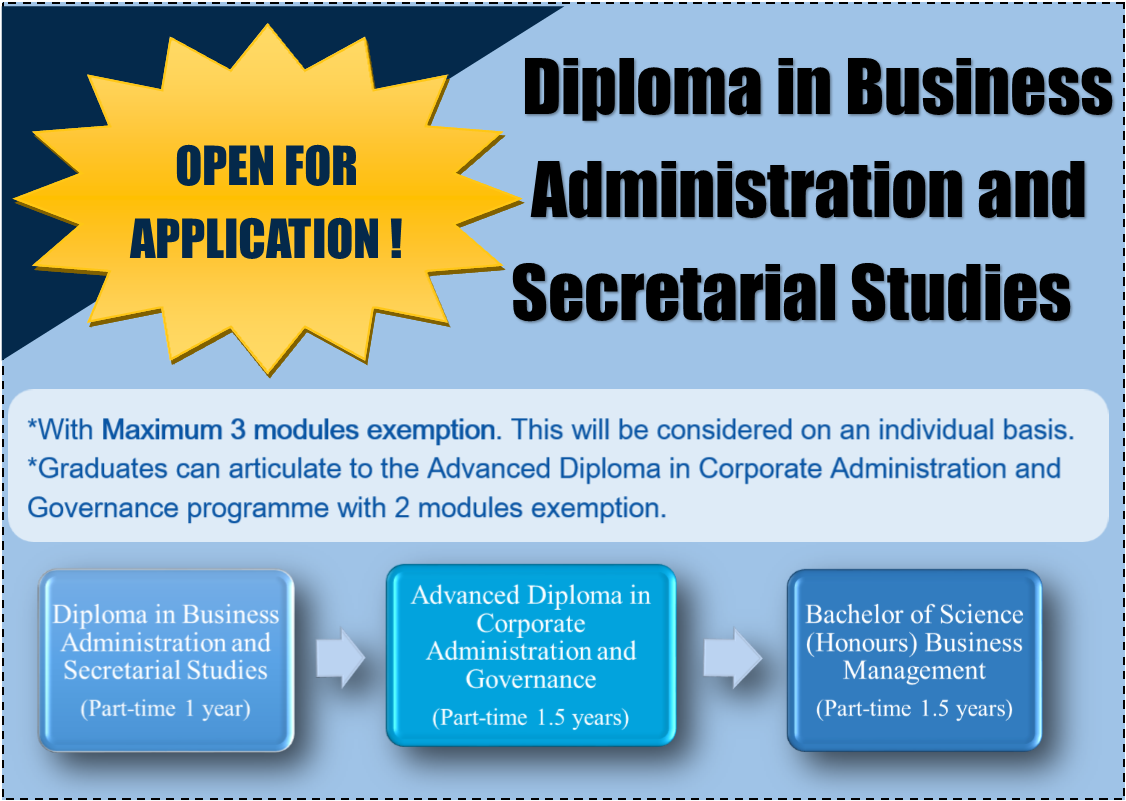

This programme aims to provide students with a solid corporate administration and governance foundation, covering general administrative management and corporate governance theories and practices. It is designed to equip students with an analytical problem-solving approach to administration and governance-related issues and contemporary issues faced by company secretaries and administrators.

PT

Start 23 FEB 2026 (MON)

Duration 20 months

Fee HK$45,500 per programme (by 3 instalments)

(*All fees are subject to change without prior notice.)

(*All fees are subject to change without prior notice.)

The programme aims to provide students with essential knowledge of robotic process automation (RPA) in streamlining workflow and improving business operations. It covers the design, development and implementation of RPA with illustrations using computational tools. Practical applications and cases of RPA for business and finance will be discussed.

PT

Start 28 FEB 2026 (SAT)

Duration 1 month to 2 months

Fee Course Fee: $9900 per programme (*course fees are subject to change without prior notice)

The programme aims to provide students with the latest development of Financial Technology (FinTech) and the contemporary issues related to Banking and Financial Services sectors. It offers knowledge about the various technological applications to enhance the competitive edges of banks, investment and securities firms. In addition, security and regulatory issues will be covered in this programme.

PT

Start 28 FEB 2026 (SAT)

Duration 2 months to 3 months

Fee Course Fee: $9900 per programme (* course fees are subject to change without prior notice)

The programme will primarily appeal to financial services executives who wish to equip themselves with latest knowledge in marine insurance for their professional advancement. The secondary target market includes business executives or new graduates who aim to take up opportunities in insurance sector with a focus of marine insurance.

PT

Start 02 MAR 2026 (MON)

Duration 3 months

Fee HK$9,800

This programme aims to provide students with knowledge in Big Data and Business Analytics for management decision-making. Students are expected to be familiar with different big data analyses, tools and methodologies. The programme provides an insight on how business world is using Big Data to improve their business models.

PT

Start 07 MAR 2026 (SAT)

Duration 1 month to 2 months

Fee Course Fee: $9500 per programme (* course fees are subject to change without prior notice)

The programme aims to provide students with the essential knowledge of business intelligence and data automation. It illustrates various techniques of data preparation, data transformation and data automation using computational tools. The programme also discusses real-life cases related to the usage of business intelligence, practical applications and implications of data automation in business.

PT

Start 11 APR 2026 (SAT)

Duration 30 hours

Fee Course Fee: $9900 per programme (* course fees are subject to change without prior notice)

This programme aims to provide students with updated knowledge of Blockchain and its practical applications in the finance and investment fields. It gives an overview of the Blockchain market and introduces students to the basic concept and jargons of Blockchain. The programme also provides the latest market landscape, insight and discussion on the application of Blockchain from the regulatory and legal perspectives.

PT

Start 14 APR 2026 (TUE)

Duration 1 month to 2 months

Fee Course Fee: $9500 per programme (* course fees are subject to change without prior notice)

This programme offers the essential concepts and contemporary issue about aircraft leasing and financing. It provides a broad overview of main categories of different aircraft leasing transactions.

PT

Start 09 MAY 2026 (SAT)

Duration 1 month to 2 months

Fee HK$7,200 (includes 2 modules)

This programme aims to provide students with knowledge about Artificial Intelligence and Deep Learning in Quantitative Finance as well as their latest developments and applications to finance and investment. It covers various learning algorithms and neural networks as well as machine intelligence to facilitate finance and investment decision making.

PT

Start 09 JUN 2026 (TUE)

Duration 2 months to 3 months

Fee Course Fee: $10500 per programme (* course fees are subject to change without prior notice)

The programme aims to provide students with the contemporary knowledge of distributed ledger and blockchain under the continuous technological advancement. It illustrates the development of smart contracts using computational tools and discusses a practical implementation of blockchain in business. The programme also covers the future development of distributed ledger and blockchain and their implications in business.

PT

Start 22 JUN 2026 (MON)

Duration 30 hours

Fee Course Fee: $10300 per programme (* course fees are subject to change without prior notice)

Hong Kong Monetary Authority (HKMA) works together with the banking industry to introduce an industry-wide competency framework – Enhanced Competency Framework (ECF) on Anti-money Laundering and Counter-financing of Terrorism (AML/CFT) to support talent development in AML/CFT. The syllabus will be provided by the Hong Kong Institute of Bankers (HKIB) and this programme is offered for students to prepare for the ECF on AML/CFT Professional Level Examination.

PT

Start 18 JUL 2026 (SAT)

Duration 18 hours

Fee HK$5,000