Accounting & Finance Financial Services and Insurance

Welcome to our CFA Level 1 program December intake. The November intake is opening for application!

Aim for the 2025 CFA Examination! Meet on Monday, Thursday and Saturday, and spend two months wisely before the CFA Examination!

Information Seminar for CFA Examination Preparatory Programme November and December intake is currently accepting application!

Programme Overview

Highlights

The programme aims to prepare students to sit for the Chartered Financial Analyst (CFA) Level I examination. It will provide students with knowledge of quantitative methods, economic and financial analysis, and portfolio management. It also covers the ethical and professional standards requirement for an asset manager.

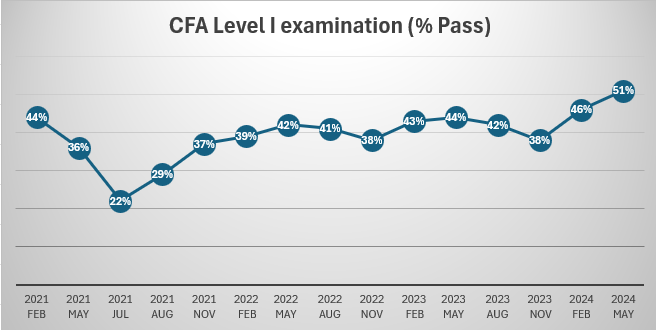

A record number of people just got good news about their CFA exam results by Business Insider

CFA exam - Half will fail… by Business Insider

| Year | Passing Rate |

| 2021 February | 44% |

| 2021 May | 25% |

| 2021 July | 22% |

| 2021 August | 26% |

| 2021 November | 27% |

| 2022 February | 36% |

| 2022 May | 38% |

| 2022 August | 37% |

| 2022 November | 36% |

| 2023 February | 38% |

| 2023 May | 39% |

| 2023 August | 37% |

| 2023 November | 35% |

| 2024 February | 44% |

| 2024 May | 51% |

Please apply online or download and complete the school application form and CEF application form, if applicable.

課程時間表及報名表可於本網頁下載。如欲報讀此課程,請填妥報名表及持續進修基金申請表(如適用)。

本課程將深入探討特許金融分析師一級考試內涵蓋的主要課題。

Programme Details

Information about CFA eligibility requirements, examination application, membership and the CFA charter is available from:

- CFA Institute(US) website, http://www.cfainstitute.org/

- CFA Institute (Asia Pacific) telephone: 2868 2700

Please note that CFA Institute does not endorse, promote, review or warrant the accuracy of the products or services offered by organisations sponsoring or providing CFA examination preparation materials or programmes, nor does CFA Institute verify pass rates or exam results claimed by such organizations. CFA is a licensed service mark of CFA Institute. For general information on the CFA programme, please look up The CFA Institute website: http://www.cfainstitute.org/.

Teachers

(1) Dr Mike Hui, MSc., CFA®

Mr Hui is a veteran in the investment and banking industry. He has over 15 years of working experience in a merchant bank and a listed brokerage firm and over 13 years of teaching experience in various tertiary institutions, including HKU SPACE and professional bodies covering finance and banking courses. He has been delivering CFA revision courses for the past 7 years and the CFP® Investments module for the past 13 years with very positive feedback. Currently he is a Sales Director in a listed investment consultant firm. Mike is a CFA charterholder. He has a Master of Science degree in Finance from the Chinese University of HK.

(2) Dr Joseph Chan

Dr Chan is an experienced trainer and consultant in the field of finance. He has been teaching numerous courses at the postgraduate level and providing consultancy to different financial institutions. He obtained his doctoral degree in finance at the University of Mississippi. Prior to returning to Hong Kong, Dr Chan had served as a research analyst and adjunct professor in the US.

(3) Ms Alex Krystal Yao, CFA®

Ms Yao has more than 20 years of experience in the financial industry. She is responsible for bond investment in investment banks and major fund management companies, and holds senior management positions. She graduated from University College London, and holds the British FCCA and CFA qualifications.

(4) Mr Wilson Chan, CFA®

Mr Chan is a seasoned investment banker. He has almost a decade of experience in origination and execution of mergers and acquisitions in Greater China. He has led and participated in local Hong Kong and China domestic transactions, as well as cross boarder transaction covering sell side, buy side, fundraising and privatisation. In addition to practical transaction experience, Mr Chan graduated from business school and is a Chartered Financial Analyst.

(5) Mr Christopher Mak, CFA®, CFP®, ACCA, CAIA, CPA (Aust.), FLMI, FRM, MHKSI

Mr. Mak has many years of experience in the financial industry, specializing in investment analysis and financial risk management. He obtained a Bachelor of Science degree from the Hong Kong University of Science and Technology, with a major in Physics and minors in Mathematics, and Social Science. Mr. Mak also attained more than 10 professional qualifications in accounting, insurance and investment-related areas. He holds the Chartered Alternative Investment Analyst (CAIA), Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Chartered Certified Accountant (ACCA), Certified Practising Accountant Australia (CPAA), RICS Chartered Surveyors (MRICS) and Fellow of Life Management Institute (FLMI) designations, and is a certified Financial Risk Manager (FRM) and Professional Risk Manager (PRM).

(6) Mr Ferrix Lau, CFA®, FRM, HKACG, ACG

Mr Lau has over 10 years’ teaching experience in business, accounting and finance modules at tertiary level. He teaches Financial Analysis, Financial Risk Management, Quantitative Analysis, Financial Accounting, Cost and Management Accounting as well as Corporate Governance. Moreover, he is a co-author of a Statistics book, Quantitative Analysis for Professional Studies and Projects. Furthermore, he has strong interests in the areas of Statistical Analysis, Quantitative Finance and Machine Intelligence. Mr Lau has earned a Bachelor's Degree in Social Science from The Chinese University of Hong Kong, major in Economics and minor in Computer Science. Besides, he holds a Master's Degree in Business Administration with Distinction from The University of Hong Kong, concentrating on the theme of Accounting Control and Financial Management.

(7) Mr Terence Tsui, CFA®

Terence Tsui is a distinguished CFA Charterholder with over 15 years of investment research and management experience. He holds a bachelor’s degree in automation engineering from The Chinese University of Hong Kong and a CFA Certificate in ESG Investing. Throughout his career, Terence has made notable contributions to fund management firms, banks, and family offices in Hong Kong, Switzerland, New Zealand, and Bangkok. His roles as an investment analyst, strategist, and portfolio manager have consistently showcased his remarkable expertise, including being part of a team that earned a 5-Star Morningstar award. Beyond his role as a seasoned practitioner, Terence is an active member of the investment community. He served as an Executive Director of the CFA Society Hong Kong, one of the world's largest CFA societies with over 6,500 members. His have made significant contributions to the CFA program, investment competitions, and topics on performance measurement, risk analysis, and public awareness.

(8) Mr Benjamin Lee, CFA®

Mr. Benjamin Lee is a Chartered Financial Analyst (CFA) Holder and currently serves as the Head of Investment Department at a local financial institution. He has over 15 years of experience in research and asset management and has previously held the position of Fund Director at a private equity fund, managing assets for international high-net-worth clients and professional investors.

Mr. Lee specializes in using fundamental analysis to evaluate the actual and potential risks of investment targets, thereby selecting the best investment targets, reducing unsystemic risk, and increasing potential returns.

On completion of the programme, students should be able to

- describe the ethical and professional standards established by the CFA Institute;

- apply quantitative methods, economics and financial statement analysis to solve conceptual, analytical, and computational problems;

- outline the concepts of corporate issuers in the financial market; and

- explain the types and markets of equity and fixed income securities, derivatives and alternative investments, and perform portfolio management and analysis.

| Application Code | 2260-FN089A | Apply Online Now |

| Apply Online Now | ||

Duration

- 58 hours + 2 hours examination

Modules & Class Details

Modules

|

Syllabus |

|

(1) Ethical and professional standards

(2) Quantitative methods

(3) Economics

(4) Financial statement analysis

(5) Corporate issuers

(6) Equity valuation

(7) Fixed Income

(8) Derivatives

(9) Alternative investments

(10) Portfolio management Assessment method: 2-hour Examination

|

Class Details

2024 December intake (confirmed launch)

The December 2024 Class is Scheduled for Monday, Thursday and Satu.

Venue: HK Island

Teacher: Dr Joseph Chan

Language of instruction: English, Cantonese

Practical Skills Modules (PSM) focus on : Python Programming Fundamentals

| Lecture | Date | Time slot | |

| 1 | 12-Dec-24 | Thu | 18:45-22:15 |

| 2 | 16-Dec-24 | Mon | 18:45-22:15 |

| 3 | 19-Dec-24 | Thu | 18:45-22:15 |

| 4 | 30-Dec-24 | Mon | 18:45-22:15 |

| 5 | 06-Jan-25 | Mon | 18:45-22:15 |

| 6 | 11-Jan-25 | Sat | 09:45 - 13:15 |

| 7 | 11-Jan-25 | Sat | 14:15 - 18:15 |

| 8 | 13-Jan-25 | Mon | 18:45 - 22:15 |

| 9 | 18-Jan-25 | Sat | 09:45 - 13:15 |

| 10 | 18-Jan-25 | Sat | 14:15 - 18:15 |

| 11 | 20-Jan-25 | Mon | 18:45 - 22:15 |

| 12 | 25-Jan-25 | Sat | 09:45 - 13:15 |

| 13 | 25-Jan-25 | Sat | 14:15 - 18:15 |

| 14 | 03-Feb-25 | Mon | 18:45 - 22:15 |

| 15 | 08-Feb-25 | Sat | 09:45 - 13:15 |

| 16 | 08-Feb-25 | Sat | 14:15 - 18:15 |

| Exam | 12-Feb-25 | Wed | 19:00 - 21:00 |

Fee & Entry Requirements

Fee

- HK$13,600(including a comprehensive set of notes and study materials which are non-refundable)

Entry Requirements

Applicants should hold a degree awarded by a recognised institution.

Applicants should check with the CFA Institute that they are eligible to attempt the examination.

CEF

- The CEF Institution Code of HKU SPACE is 100

| CEF Courses | ||

|---|---|---|

| Certificate for Module (CFA Level I Examination Preparatory Programme) 證書 (單元:特許金融分析師一級考試研習課程) |

||

| COURSE CODE 33C144182 | FEES $13,600 | ENQUIRY 2867-8468 |

Continuing Education Fund

|

Continuing Education Fund This course has been included in the list of reimbursable courses under the Continuing Education Fund. |

Certificate for Module (CFA Level I Examination Preparatory Programme)

|

Apply

Online Application Apply Now

Application Form Download Application Form

Enrolment MethodOnline Enrolment

HKU SPACE provides 24-hour online application and payment service for students to apply to selected award-bearing programmes and to enrol in most open admission courses (courses enrolled on a first come, first served basis) via the Internet. Applicants may settle the payment by using either "PPS by Internet" (not available via mobile phones), VISA or Mastercard online. Online WeChat Pay, Online AliPay and Faster Payment System (FPS) are also available for continuing enrolment in the same programme, if online service is offered.

For first time enrolment

-

Complete the online application form

Applicant may click the icon

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

Some programmes/courses may admit by selection, and may require applicants to provide electronic copy of any required documents (e.g. proof of qualification) as indicated on the programme/course webpage. Only file format in doc, docx, jpg and pdf are supported. -

Make Online Payment

Pay the application or programme/course fees by either using:

"PPS by Internet" - You will need a PPS account and a PPS Internet password. For information on how to open a PPS account and how to set up a PPS Internet password, please visit http://www.ppshk.com.

*Credit Card Online Payment - Course fees can be paid by VISA or Mastercard including the “HKU SPACE Mastercard”.

* HKU SPACE Mastercard cardholders who wish to enjoy 10-month interest free instalment scheme must pay their tuition fees in person at any of our HKU SPACE Enrolment Centres.

To know more about first-time online application/enrolment and payment, please refer to the user guide of Online Application / Enrolment and Payment:

For continuing enrolment in the same programme

Selected programmes offer online continuing enrolment service. Programme staff will inform students if they offer this service and offer further enrolment details.

Online Payment can be made via "PPS by Internet" (not available via mobile phones), VISA or Mastercard, Online WeChat Pay, Online AliPay and Faster Payment System (FPS)

In Person / Mail

For first time enrolment

-

For first come, first served short courses, complete the Application for Enrolment Form SF26 and bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

[Download Enrolment Form SF26] -

Award-bearing and professional courses may require other information. Forms are usually available at the enrolment centres or on request from programme staff. Bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

For continuing enrolment in the same programme

-

The standard ‘Enrolment/Payment Slip’ is designed for students of award-bearing programmes or remaining programmes in a suite of programmes requiring continuing enrolment and it applies to most programmes.

-

Students should complete the “Enrolment/Payment Slip” which will be made available by relevant programme staff and return the slip to any HKU SPACE enrolment centre or post it to the relevant programme staff with appropriate fee payment.

Please refer to available Payment Methods for fee payment information. If you are in doubt about the procedures, please check the individual course details, or contact our programme staff or enrolment centres.

Please note the followings for programme/course enrollment:

- To make an application online, you will need a computer with connection to the Internet and a web browser with JavaScript enabled. Google Chrome is recommended.

- Applicants should not leave the online application idle for more than 10 minutes. Otherwise, applicants must restart the application process.

- Only Early Bird Discount is supported for Online Applicants (Application). To enjoy other types of discount, please visit one of our enrolment centres.

- During the online application process, asynchronous application and payment submission may occur. Successful payment may not guarantee successful application. In case of unsuccessful submission, our programme staff will contact you shortly.

- Applicants are reminded that they should only apply for the same programme/course once through counter or online application.

- For online enrolment, a payment confirmation page would be displayed after payment has been made successfully. In addition, a confirmation email would also be sent to your email account. You are advised to keep your payment confirmation for future enquiries.

- Fees paid are not refundable except as statutorily provided or under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment).

- If admission is by selection, the official receipt is not a guarantee that your application has been accepted. We will inform you of the result as soon as possible after the closing date for application. Unsuccessful applicants will be given a refund of programme/course fee if already paid.

Disclaimer

The School provides a platform for online services for a selected range of products it offers. While every effort is made to ensure timeliness and accuracy of information contained in this website, such information and materials are provided "as is" without express or implied warranty of any kind. In particular, no warranty or assurance regarding non-infringement, security, accuracy, fitness for a purpose or freedom from computer viruses is given in connection with such information and materials.

The School (and its respective employees and subsidiaries) is not liable for any loss or damage in connection with any online payments made by you by reason of (i) any failure, delay, interruption, suspension or restriction of the transmission of any information or message from any payment gateways of the relevant banks and/or third party merchants for processing credit/debit/smart card or other payment facilitation mechanism; (ii) any negligence, mistake, error in or omission from any information or message transmitted from the said payment gateways; (iii) any breakdown, malfunction or failure of those gateways in effecting online payment service or (iv) anything arisen out of or in connection with the said payment gateways, including but not limited to unauthorised access to or alternation of the transmission of data or any unlawful act not permitted by the law.

1. Cash, EPS, WeChat Pay Or Alipay

Course fees can be paid by cash, EPS, WeChat Pay or Alipay at any HKU SPACE Enrolment Centres.

2. Cheque Or Bank draft

Course fees can also be paid by crossed cheque or bank draft made payable to “HKU SPACE”. Please specify the programme title(s) for application and applicant’s name. You may either:

- bring the completed form(s), together with the appropriate course or application fees in the form of a cheque, and any required supporting documents to any of the HKU SPACE enrolment centres;

- or mail the above documents to any of the HKU SPACE Enrolment Centres, specifying “Course Application” on the envelope. HKU SPACE will not be responsible for any loss of personal information and payment sent by mail.

3. VISA/Mastercard

Applicants may also pay the course fee by VISA or Mastercard, including the “HKU SPACE Mastercard”, at any HKU SPACE enrolment centres. Holders of the HKU SPACE Mastercard can enjoy a 10-month interest-free instalment period for courses with a tuition fee worth a minimum of HK$2,000; however, the course applicant must also be the cardholder himself/herself. For enquiries, please contact our staff at any enrolment centres.

4. Online Payment

Online application / enrolment is offered for most open admission courses (enrolled on first come, first served basis) and selected award-bearing programmes. Application fees and course fees of these programmes/courses can be settled by using "PPS by Internet" (not available via mobile phones), VISA or Mastercard. In addition to the aforesaid online payment channels, new and continuing students of award-bearing programmes with available online service, they may also pay their course fees by Online WeChat Pay, Online Alipay or Faster Payment System (FPS). Please refer to Enrolment Methods - Online Enrolment for details.

Notes

-

If the programme/course is starting within five working days, application by post is not recommended to avoid any delays. Applicants are advised to enrol in person at HKU SPACE Enrolment Centres and avoid making cheque payment under this circumstance.

-

Fees paid are not refundable except under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment), subject to the School’s discretion. In exceptional cases where a refund is approved, fees paid by cash, EPS, WeChat Pay, Alipay, cheque, FPS or PPS by Internet will be reimbursed by a cheque, and fees paid by credit card will be reimbursed to the credit card account used for payment.

- In addition to the published fees, there may be additional costs associated with individual programmes. Please refer to the relevant course brochures or direct any enquiries to the relevant programme team for details.

- Fees and places on courses cannot be transferrable from one applicant to another. Once accepted onto a course, the student may not change to another course without approval from HKU SPACE. A processing fee of HK$120 will be levied on each approved transfer.

- HKU SPACE will not be responsible for any loss of payment, receipt, or personal information sent by mail.

- For payment certification, please submit a completed form, a sufficiently stamped and self-addressed envelope, and a crossed cheque for HK$30 per copy made payable to “HKU SPACE” to any of our enrolment centres.

- More Programmes of

- Financial Services and Insurance Investment Management

- Relevant Programmes

- Chartered Financial Analyst Refresher Course - Level 1 Chartered Financial Analyst Refresher Course - Level 2 Chartered Financial Analyst Refresher Course - Level 3 Certificate for Module (CFA Level III Examination Preparatory Programme) Certificate for Module (CFA Level II Examination Preparatory Programme) CFA Practical Skills Module Workshop Series (Financial Modeling) CFA Practical Skills Module Workshop Series (Python Programming Fundamentals) CFA Practical Skills Module Workshop Series (Python, Data Science & AI) CFA Practical Skills Module Workshop Series (Analyst Skills) Postgraduate Diploma in Investment Management and Financial Intelligence Postgraduate Diploma in Investment Management Executive Certificate in Applied Financial Risk Management Executive Diploma in Financial Analytics