Accounting & Finance FinTech and Financial Intelligence

Today and Upcoming Events

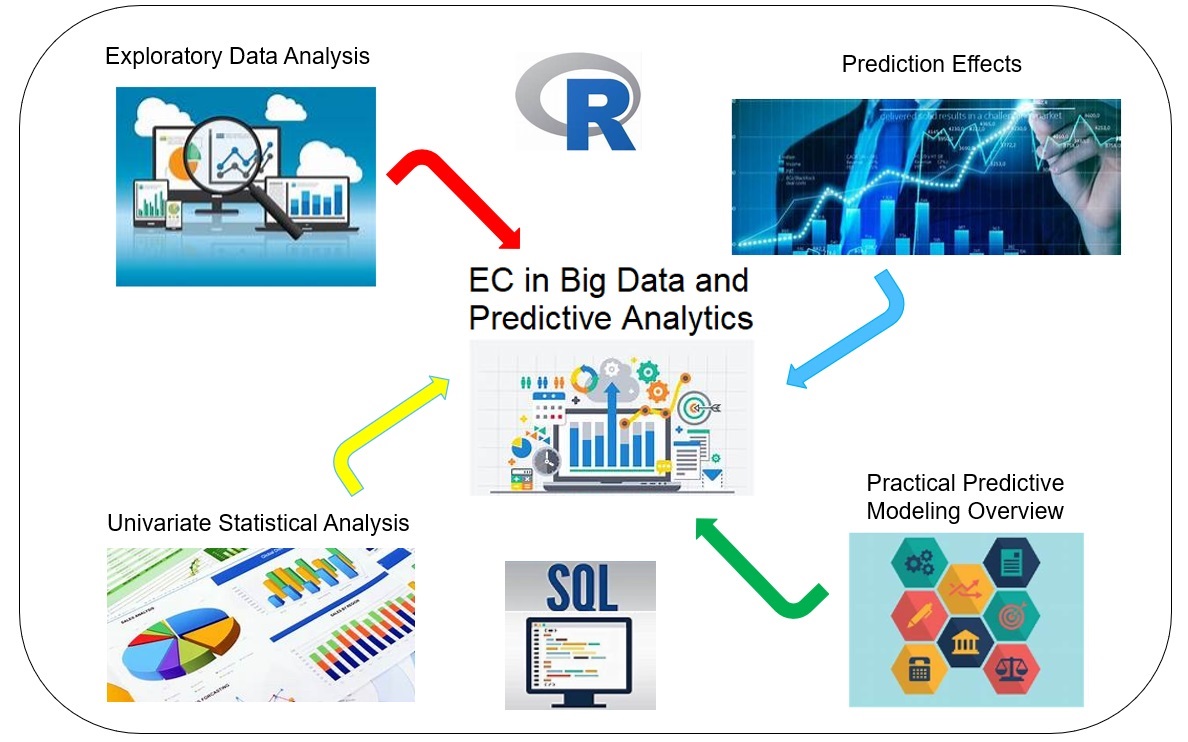

Accept new applications for May 2024 intake! There will be practical classes in the computer laboratory. Predictive analytics is an essential branch of data analytics. This programme will introduce data preprocessing, data transformation, data mining, SQL programming and R programming. Also, statistical analysis, hypothesis test and regression will be discussed. Our experienced lecturer will share the practical application of predictive analytics from practitioner viewpoints. Welcome to your online application!

Programme Overview

Highlights

Programme Details

On completion of the programme, students should be able to:

1. apply knowledge and skills in the procedure of processing and cleaning of Big Data;

2. build simple hypothesis modelling to gain insights from voluminous data within a business setting;

3. identify the limits and potentials of data mining and predictive analytics;

4. utilize existing Big Data algorithms and tools made available online for predictive analysis;

5. self-explore commonly available off-the-shelf Big Data tools, algorithms and methodologies;

6. differentiate the role of Data Scientist from Business Analyst.

| Application Code | 2185-EP105A | Apply Online Now |

| Apply Online Now | ||

Days / Time

- Tue, Thu, 7:00pm - 10:00pm

- 30 hours per module

- 10 meeting(s)

- 3 hours per meeting

- Kowloon Campus

- Hong Kong Island Campus

Modules & Class Details

Modules

Course Content

Data preprocessing

- Data mining

- Data cleaning

- Handling missing data

- Identifying misclassifications

- Data transformation

- Flag variables

- Transforming categorical variables into numerical variables

- Removing useless variables

Exploratory Data Analysis (EDA)

- Analyzing data sets to summarize their main characteristics

- Initial data analysis (IDA) to check assumptions for model fitting and hypothesis testing, handling missing values and make transformations of variables

Univariate Statistical Analysis

- Data mining to discover knowledge in data

- Statistical approaches to estimation and prediction

- Statistical tools for testing hypotheses and deriving estimates

- Confidence interval estimation of mean

- Hypothesis testing

- Access strength of evidence against Null Hypothesis

- Regression Models

Prediction Effect

- The limits and potential of predictions

- Financial Services Case Studies

Big Data Tools and Algorithm Exploration

- Usage of different off-the-shelf tools & algorithm

- Additional Freewares introduction for predictive analysis

Role of Data Scientist

Challenges and opportunities with Big Data

- Data acquisition and recording

- Information extraction and cleaning

- Data integration, aggregation and representation

- Query processing, data modelling and analysis

- Interpretation

- Heterogeneity and incompleteness

- Scale

- Timeliness

- Privacy

- System architecture

The popular Big Data & Predictive Analytics Tools & Technique

- Usage of different off-the-shelf tools & algorithm

- Additional Freeware introduction for predictive analysis

Exploratory Data Analysis Overview

- Data profiling & cleaning

- Initial data analysis to check assumptions for model fitting and hypothesis.

SQL Programming & R Programming Overview

- Query processing by SQL

- Predictive Modeling by R

Practical Predictive Modeling Overview

- Regression Models Overview

Project & Case Studies

Assessment method: class participation + assignment

The Executive Certificate will be conferred to candidates who have attained PASS grade and achieved at least 70% attendance of the programme.

Teacher

(1) Mr. Alex Hung

Mr. Hung, Data Analytics Manager APAC at an international insurance firm, is a seasoned Data Analytics professional with more than 10 years of project experience in data analytics (Fraud Risk Analytics / Customer Analytics / Performance Management / Balance Scorecard / Business Intelligence / Data mining / Big data) solution design and development. He has in-depth knowledge and experience in the Banking and Insurance industries and proven track record of shaping and delivery complex large-scale data analytics projects. Mr. Hung received an MBA from CUHK and is a Certified Project Management Professional (PMP).

(2) Dr. Jason Liao

Dr. Jason Liao obtained his Bachelor and Master degrees from Tsinghua University and PhD from HKUST. He is a Qlik Sense Data Architect with certification. He has lots of working experience and wide expertise in big data, business intelligence, machine learning and FinTech innovation. He is proficient in BI data model/dashboard development, R, Python, SQL, etc. During his past working experience, either internal or external training took a rather large portion, and he elicited favorable comments froms trainees.

Class Details

Timetable

| Lecture | Date | Time |

| 1 | 21 May 24 (Tue) | 19:00-22:00 |

| 2 | 23 May 24 (Thu) | 19:00-22:00 |

| 3 | 28 May 24 (Tue) | 19:00-22:00 |

| 4 | 30 May 24 (Thu) | 19:00-22:00 |

| 5 | 4 Jun 24 (Tue) | 19:00-22:00 |

| 6 | 6 Jun 24 (Thu) | 19:00-22:00 |

| 7 | 11 Jun 24 (Tue) | 19:00-22:00 |

| 8 | 13 Jun 24 (Thu) | 19:00-22:00 |

| 9 | 18 Jun 24 (Tue) | 19:00-22:00 |

| 10 | 20 Jun 24 (Thu) | 19:00-22:00 |

Remarks:

-Tentative timetable is subject to change, and course commencement is subject to sufficient enrollment numbers.

-To ensure that students’ academic progress is not affected, the School may substitute face-to-face classes with online teaching if face-to-face classes cannot be held.

Fee & Entry Requirements

Fee

HK$150 (Student only needs to pay one time application fee for all EC in Big Data Series)

Course Fee- Course Fee: $8500 per programme (* course fees are subject to change without prior notice)

Entry Requirements

Applicants shall hold:

a) a bachelor’s degree awarded by a recognized University or equivalent; or

b) an Associate Degree/ a Higher Diploma or equivalent, and have at least 2 years of working experience

Applicants with other qualification and substantial senior level work experience will be considered on individual merit.

**Please upload copy of HKID and proof of degree while applying online.

Apply

Online Application Apply Now

Application Form Download Application Form

Enrolment MethodOnline Enrolment

HKU SPACE provides 24-hour online application and payment service for students to apply to selected award-bearing programmes and to enrol in most open admission courses (courses enrolled on a first come, first served basis) via the Internet. Applicants may settle the payment by using either "PPS by Internet" (not available via mobile phones), VISA or Mastercard online. Online WeChat Pay, Online AliPay and Faster Payment System (FPS) are also available for continuing enrolment in the same programme, if online service is offered.

For first time enrolment

-

Complete the online application form

Applicant may click the icon

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

Some programmes/courses may admit by selection, and may require applicants to provide electronic copy of any required documents (e.g. proof of qualification) as indicated on the programme/course webpage. Only file format in doc, docx, jpg and pdf are supported. -

Make Online Payment

Pay the application or programme/course fees by either using:

"PPS by Internet" - You will need a PPS account and a PPS Internet password. For information on how to open a PPS account and how to set up a PPS Internet password, please visit http://www.ppshk.com.

*Credit Card Online Payment - Course fees can be paid by VISA or Mastercard including the “HKU SPACE Mastercard”.

* HKU SPACE Mastercard cardholders who wish to enjoy 10-month interest free instalment scheme must pay their tuition fees in person at any of our HKU SPACE Enrolment Centres.

To know more about first-time online application/enrolment and payment, please refer to the user guide of Online Application / Enrolment and Payment:

For continuing enrolment in the same programme

Selected programmes offer online continuing enrolment service. Programme staff will inform students if they offer this service and offer further enrolment details.

Online Payment can be made via "PPS by Internet" (not available via mobile phones), VISA or Mastercard, Online WeChat Pay, Online AliPay and Faster Payment System (FPS)

In Person / Mail

For first time enrolment

-

For first come, first served short courses, complete the Application for Enrolment Form SF26 and bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

[Download Enrolment Form SF26] -

Award-bearing and professional courses may require other information. Forms are usually available at the enrolment centres or on request from programme staff. Bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

For continuing enrolment in the same programme

-

The standard ‘Enrolment/Payment Slip’ is designed for students of award-bearing programmes or remaining programmes in a suite of programmes requiring continuing enrolment and it applies to most programmes.

-

Students should complete the “Enrolment/Payment Slip” which will be made available by relevant programme staff and return the slip to any HKU SPACE enrolment centre or post it to the relevant programme staff with appropriate fee payment.

Please refer to available Payment Methods for fee payment information. If you are in doubt about the procedures, please check the individual course details, or contact our programme staff or enrolment centres.

Please note the followings for programme/course enrollment:

- To make an application online, you will need a computer with connection to the Internet and a web browser with JavaScript enabled. Google Chrome is recommended.

- Applicants should not leave the online application idle for more than 10 minutes. Otherwise, applicants must restart the application process.

- Only Early Bird Discount is supported for Online Applicants (Application). To enjoy other types of discount, please visit one of our enrolment centres.

- During the online application process, asynchronous application and payment submission may occur. Successful payment may not guarantee successful application. In case of unsuccessful submission, our programme staff will contact you shortly.

- Applicants are reminded that they should only apply for the same programme/course once through counter or online application.

- For online enrolment, a payment confirmation page would be displayed after payment has been made successfully. In addition, a confirmation email would also be sent to your email account. You are advised to keep your payment confirmation for future enquiries.

- Fees paid are not refundable except as statutorily provided or under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment).

- If admission is by selection, the official receipt is not a guarantee that your application has been accepted. We will inform you of the result as soon as possible after the closing date for application. Unsuccessful applicants will be given a refund of programme/course fee if already paid.

Disclaimer

The School provides a platform for online services for a selected range of products it offers. While every effort is made to ensure timeliness and accuracy of information contained in this website, such information and materials are provided "as is" without express or implied warranty of any kind. In particular, no warranty or assurance regarding non-infringement, security, accuracy, fitness for a purpose or freedom from computer viruses is given in connection with such information and materials.

The School (and its respective employees and subsidiaries) is not liable for any loss or damage in connection with any online payments made by you by reason of (i) any failure, delay, interruption, suspension or restriction of the transmission of any information or message from any payment gateways of the relevant banks and/or third party merchants for processing credit/debit/smart card or other payment facilitation mechanism; (ii) any negligence, mistake, error in or omission from any information or message transmitted from the said payment gateways; (iii) any breakdown, malfunction or failure of those gateways in effecting online payment service or (iv) anything arisen out of or in connection with the said payment gateways, including but not limited to unauthorised access to or alternation of the transmission of data or any unlawful act not permitted by the law.

1. Cash, EPS, WeChat Pay Or Alipay

Course fees can be paid by cash, EPS, WeChat Pay or Alipay at any HKU SPACE Enrolment Centres.

2. Cheque Or Bank draft

Course fees can also be paid by crossed cheque or bank draft made payable to “HKU SPACE”. Please specify the programme title(s) for application and the applicant’s name.. You may either:

- bring the completed form(s), together with the appropriate course or application fees in the form of a cheque, and any required supporting documents to any of the HKU SPACE enrolment centres;

- or mail the above documents to any of the HKU SPACE Enrolment Centres, specifying “Course Application” on the envelope. HKU SPACE will not be responsible for any loss of payment sent by mail.

3. VISA/Mastercard

Applicants may also pay the course fee by VISA or Mastercard, including the “HKU SPACE Mastercard”, at any HKU SPACE enrolment centres. Holders of the HKU SPACE Mastercard can enjoy a 10-month interest-free instalment period for courses with a tuition fee worth a minimum of HK$2,000; however, the course applicant must also be the cardholder himself/herself. For enquiries, please contact our staff at any enrolment centres.

4. Online Payment

Online application / enrolment is offered for most open admission courses (course enrolled on first come, first served basis) and selected award-bearing programmes. Application fees and course fees of these programmes/courses can be settled by using "PPS by Internet" (not available via mobile phones), VISA or Mastercard. In addition to the aforesaid online payment channels, continuing students of award-bearing programmes, if their programmes offer online service, may also pay their course fees by Online WeChat Pay, Online Alipay and Faster Payment System (FPS). Please refer to Enrolment Methods - Online Enrolment for details.

Notes

- If the programme/course is starting within five working days, application by post is not recommended to avoid any delays. Applicants are advised to enrol in person at HKU SPACE Enrolement Centres and avoid making cheque payment under this circustance.

- Fees paid are not refundable except under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment), subject to the School’s discretion. In exceptional cases where a refund is approved, fees paid by cash, EPS, WeChat Pay, Alipay, cheque or PPS (for online payment only) will normally be reimbursed by a cheque, and fees paid by credit card will normally be reimbursed to the payment cardholder's credit card account.

- In addition to the published fees, there may be additional costs associated with individual programmes. Please refer to the relevant course brochures or direct any enquiries to the relevant programme team for details.

- Fees and places on courses cannot be transferrable from one applicant to another. Once accepted onto a course, the student may not change to another course without approval from HKU SPACE. A processing fee of HK$120 will be levied on each approved transfer.

- Receipts will be issued for fees paid but HKU SPACE will not be repsonsible for any loss of receipt sent by mail.

- For payment certification, please submit a completed form, a sufficiently stamped and self-addressed envelope, and a crossed cheque for HK$30 per copy made payable to "HKU SPACE" to any of our enrolment centres.

- More Programmes of

- FinTech and Financial Intelligence Data Science

- Relevant Programmes

- Executive Certificate in Big Data and Business Analytics Executive Certificate in Big Data, A.I. and Investing Executive Certificate in Applied AI and Predictive Analytics for Business Executive Certificate in Financial Decision Making: Big Data and Machine Learning Executive Certificate in Interpretation and Visualization of Business Big Data Executive Diploma in Financial Analytics Executive Certificate in Applications of Blockchain in Financial Technology Executive Certificate in Applied Financial Risk Management Executive Certificate in Applied AI and Predictive Analytics for Business Executive Certificate in Applied Business Analytics and Decision Optimization Postgraduate Diploma in Investment Management Postgraduate Diploma in Investment Management and Financial Intelligence Postgraduate Diploma in Finance and Data Analytics